SASSA Status Check for R370 (P-R350) – SRD Status Check Online

Have you applied for the SASSA grant and want to check its status and approval? Fortunately, various methods help us check our SASSA grant status in a few clicks. You can perform a SASSA status check for R370 (Previously R350) by adding a few details in SASSA’s given platforms, and results will be in front of you whether it is pending, approved, or declined.

SASSA has set numerous ways through which you can check the status of your application. These platforms will fetch your application’s status and the reason for denial if denied.

These methods are very easy to access, and SASSA has ensured that every applicant gets news of their application one way or another.

This article covers everything related to the SASSA Status Check. Read this complete article as I’ll unveil many details about this process and some important tips to help you get the SASSA grant.

Update: SASSA Status Check for R350, now referred to as R370, January 2025 Payment Dates Released

How To Check The Status Of My Sassa R370 (Previously R350)?

There are many ways to check the status of the SASSA R370 (Previously R350) grant. The multiple methods allow us to ensure that we can successfully get the data, especially if there is a delayed response in one option; you can try other methods to check the status quickly.

Here is a list of 4 ways that you can use to check SASSA Status online.

- Check SRD status Online.

- Check SRD status through WhatsApp

- Check SRD status through the Moya App

- Check SRD status through the SASSA Helpline

Required Information for Checking SASSA Status Online

As you know, you need some details to proceed while applying for the SASSA grant. Similarly, for checking SASSA status, you need a few details to add to the database. These details are vital to getting the specific information for your account. Here is a list of details you need to check your SASSA status online.

1. Applicant ID Number

Your Applicant ID Number is a unique identity code associated with your SASSA grant application. This number is assigned to you when you initiate the application process. It is a digital fingerprint, helping the system locate and pull up your information from the database.

If you don’t have your Applicant ID, here’s how to find it:

- You can find your applicant ID number on any email or confirmation document you receive during the application process.

- You often find it in the confirmation SMS or email you receive after submitting your application.

2. Phone Number

Your phone number is the contact point through which SASSA can reach you. It is essential in the status check process to ensure you obtain timely application updates. Ensure the phone number you provide is the same as the one you registered with and are currently using.

How to Check the Status of Your SASSA R370 (Previously R350) Application Online

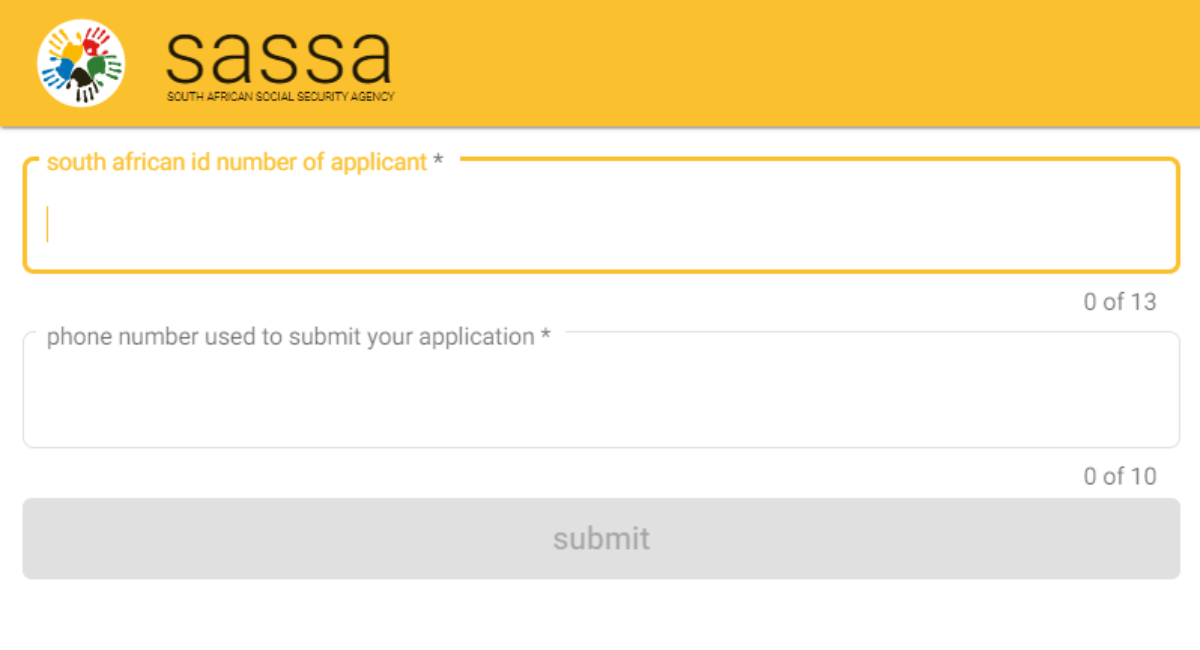

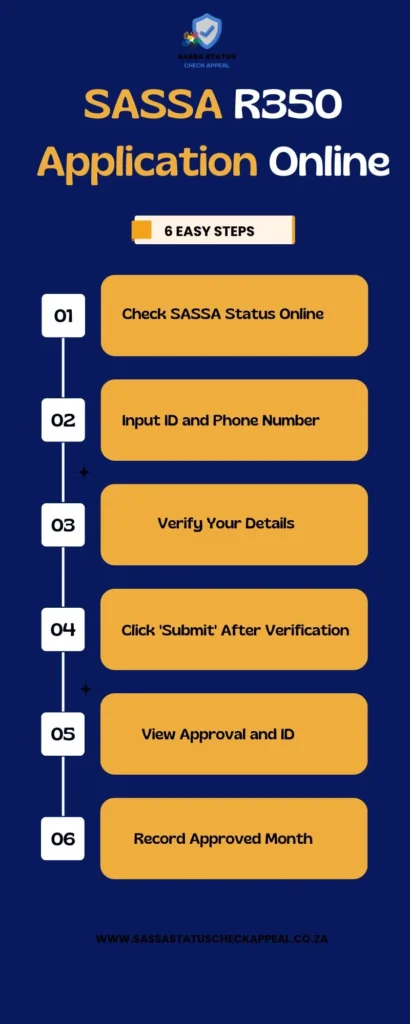

To check the status of your R370 application online, all you need is your South African ID number and the phone number you used for registration. Once you have that, follow this step-by-step guide on how to check your SASSA R370 (Previously R350) status online:

- Visit the official website, sassa.gov.za You can do this using your computer, tablet, or mobile phone.

- There will be a section that will ask for your ID number and phone number. Enter both of these in the required sections.

- Double-check your entries to make sure they’re correct.

- Once you confirm the correctness of the information entered, click the ‘Submit’ button.

- The system will now process your request. Within a few moments, your screen will display the approved month and your precise application ID.

- Take note of the approved month. This period represents the time for which authorities have authorized your grant.

How to Check SASSA SRD R370 (Previously R350) Status through WhatsApp

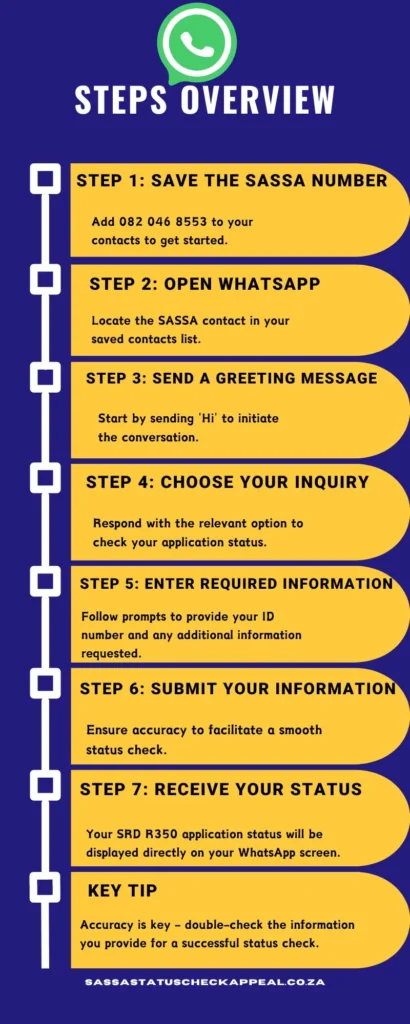

Checking your status through WhatsApp is the easiest way possible. Here’s how to check your status through WhatsApp:

- Add the SASSA WhatsApp number, 082 046 8553, to your contacts.

- Open WhatsApp and find the SASSA contact in your saved contacts.

- Send a greeting message like “Hi” to start the conversation.

- After your first message, you’ll get an automatic reaction offering a list of options.

- Select the option that relates to checking your application status.

- Follow the instructions to enter your ID number and other information they request.

- Provide the data correctly to ensure a successful status check.

- After finishing the process, the SASSA system will display your SRD R370 (Previously R350) status on your WhatsApp screen.

How to Check SASSA SRD R370 (Previously R350) Status through the Moya App

Moya is an app for checking the status of your SASSA application, along with other services. Here’s how you can check your R370 status through the Moya app:

- Go to your mobile device’s Apple App Store or Google Play Store.

- Search for the Moya app and download it.

- Open the Moya app on your device.

- Find the Discovery section inside the app.

- In the Discovery section, pick out the SASSA Grant option.

- There will be a drop-down menu related to SASSA SRD repute.

- Select the “Application Status” option out of the available picks.

- Enter your ID number and other records in the designated fields as asked.

- After entering the information, click the “Submit” button to continue.

- The screen will display your SASSA SRD status.

- Check whether your application is approved, pending, or rejected.

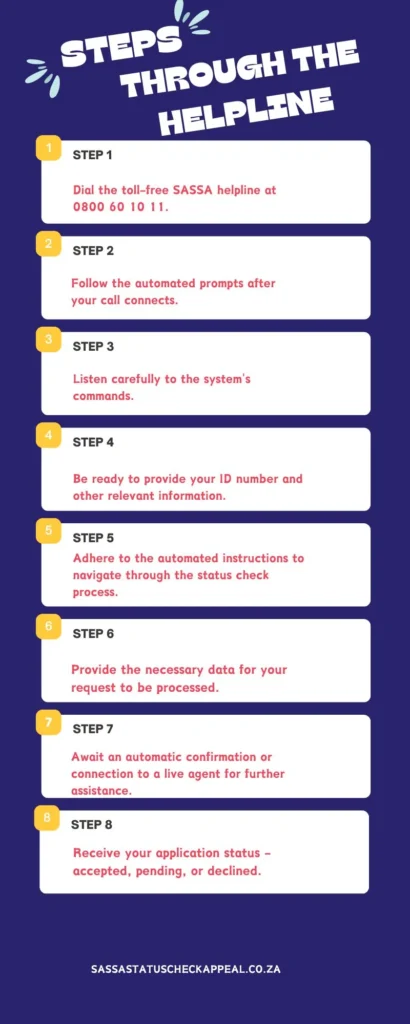

How to Check SASSA SRD R370 (Previously R350) Status through the Helpline

For those who want a more direct approach, you can check your R370 status through SASSA’s helpline. Follow these steps:

- Dial the toll-free SASSA helpline number, 0800 60 10 11.

- Once your call connects, you will be guided through automated prompts.

- Listen carefully to the commands provided by the system.

- Be prepared to provide important information, which includes your ID number and other information applicable to your application.

- As directed by the automated device, follow the prompts to go through the status-check process.

- After providing the required data, the system will process your request.

- You may also obtain an automatic confirmation or be connected to a live agent for more assistance.

- If automatic, the system will convey your SRD status, indicating whether or not your application is accepted, pending, or declined.

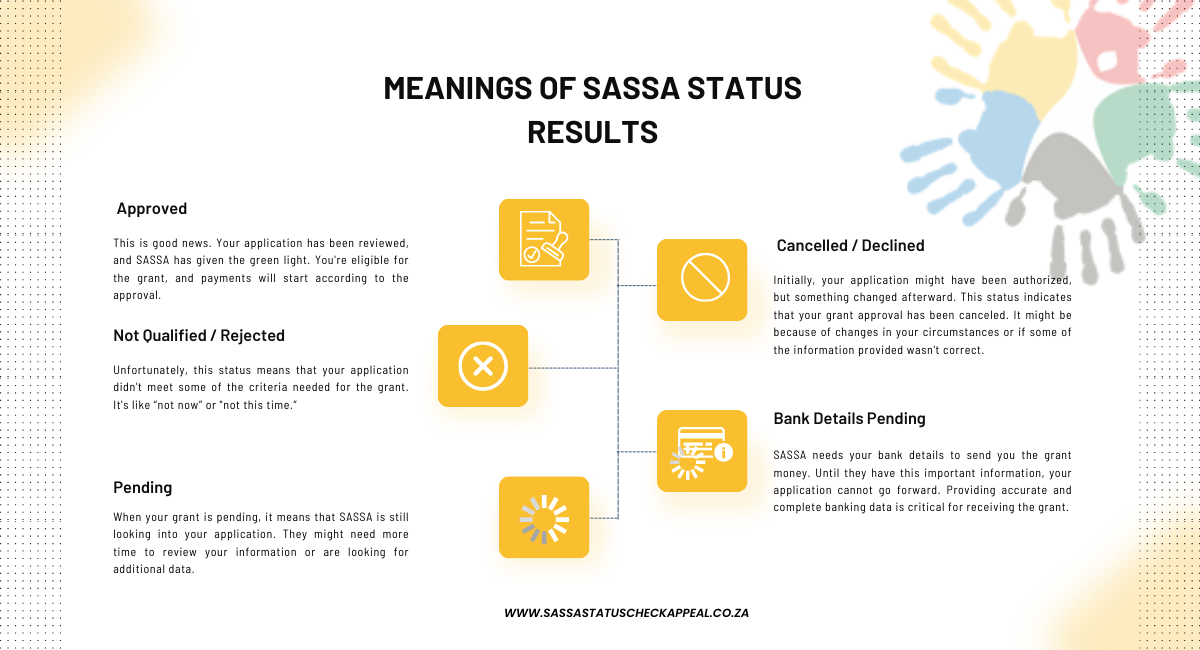

SASSA Grant Status Result Meaning

When you get your SASSA Grant Status, it will give you some response or reason for the decision. Let’s break down these reasons and their meanings:

1. Alternative Income Source Identified

When your SASSA status says “Alternative Income Source Identified,” it means that the system has detected other sources of income for you. This result implies that you’re deemed ineligible for the SASSA grant based on the identified income source. The program is made to assist those without extra income resources.

2. Means Income Source Identified

If your status shows “Means Income Source Identified,” you have stated income from multiple resources, such as employment, investments, or retirement finances. Recognition of multiple sources of income renders you ineligible for the SASSA grant. The application is meant for those going through financial distress without alternative support means.

3. Application Complete

When your SASSA status says “Application Complete,” it shows that you have completed the reapplication process. Your application is now in the verification process, and SASSA will review all of your information for eligibility in the SRD R370 (Previously R350) grant program.

4. Bank Details Pending

If your status says “Bank Details Pending,” . Your application or reapplication has been obtained, but no bank account information has been provided. You must post your banking information on the official website to continue the payment process. This step ensures the secure transfer of grant funds.

See Also: SASSA Change Banking Details

5. Reapplication Pending

A “Reapplication Pending” status suggests that no application or reapplication has been received for the SRD R370 (Previously R350) supply. To be considered for the SASSA grant, you must make a fresh application via the SASSA website. This step is necessary to initiate the processing of your request.

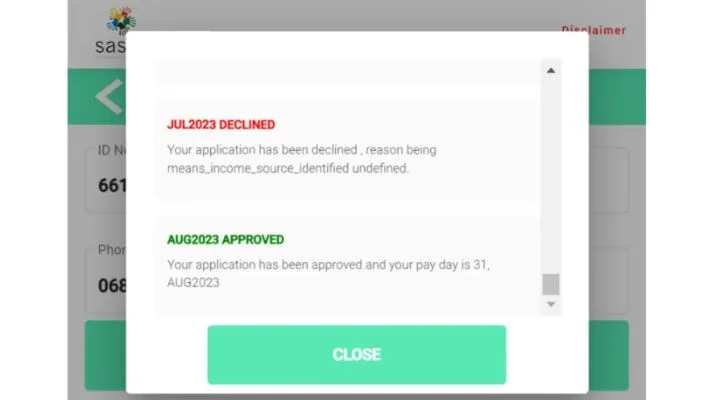

6. Aug Pending/Approved/Declined

For statuses related to the August period, “Aug Pending” implies that verification is pending, “Aug Approved” means your application was accepted, and “Aug Declined” indicates a declined application.

For “Aug Pending,” check back later for updates. “Aug Approved” shows approval of your application; check the payday field for disbursement details. “Aug Declined” provides a reason, and you can appeal if you believe it’s invalid.

Why Your SASSA Grant Payment Might Take Longer Than Expected

Getting your SASSA grant money on time is essential for many, but sometimes the process takes longer than expected. Here are some reasons why your payment is taking longer than expected:

1. Technical Hiccups

Technical problems can occur in the computer systems or tools for managing grant payments. This involves glitches, errors, or malfunctions that need to be solved. These technical problems can slow down the whole payment method, causing delays in disbursing your grant money.

2. Processing Your Information

SASSA carefully checks the applicants’ details to ensure accuracy and eligibility for the grant. This involves cross-referencing information with different government databases. If errors or missing statistics arise during the verification process, resolving these issues will require more time, potentially leading to payment delays.

3. Administrative Workload

Processing and handling the administrative side of grant packages involves a heavy workload. Tasks, including office work, record entry, and document verification, can sometimes take longer than expected. Administrative delays cause long timelines for completing essential tasks. This contributes to delays in the grant payment process.

4. High Volume of Applications

When many people apply for the grant, it can crash the system. The sheer volume of applications takes more than normal time and resources for thorough processing. SASSA experiences delays in reviewing and processing applications, pushing the timeline for disbursing the grant amount.

5. Weekend and Holiday Considerations

During weekends or public holidays, offices may work with restricted personnel or be closed altogether. This disrupts the usual work routine. Processing timelines slow down during these periods, causing temporary delays in the regular schedule of grant payments.

SASSA is dedicated to resolving problems and ensuring timely grant payments to applicants. The organization works to cope with technical problems and improve its administrative processes. SASSA’s commitment to resolving issues, despite potential delays, demonstrates its dedication to ensuring you receive your grant money promptly.

Why Your SASSA Grant Application Might Have Been Declined

Having your SASSA grant application declined can be disheartening, but it’s important to understand the reason behind this decision. Here are the key reasons why your application might have been rejected:

- UIF Enrollment. If you’re already getting help from the Unemployment Insurance Fund (UIF), you might not qualify for an extra SASSA grant, and they’ll say no to your request.

- NSFAS Support. If you are getting payments from the National Student Financial Aid Scheme (NSFAS), SASSA might not approve your application for an extra grant.

- Incorrect Information. If you enter incorrect information in your application, such as mixing up your details or providing untrue information, SASSA might not approve your grant.

- Incomplete Applications. If you forget to fill in all the required details or leave some stuff out when you apply, SASSA might not be able to decide if you should get the grant, and they might say no.

- Dependency Criteria. Sometimes, you must fulfill specific situations, like having certain dependents, to get a grant. If you don’t meet those conditions, SASSA may not approve your application.

- Residency Requirements. SASSA needs you to stay in the country to qualify for a grant. They will reject your application if you do not stay in the country.

- Disqualification by way of Law. There are some laws you need to follow to get the grant. If you violate these laws, SASSA could say no to your application.

- Age Requirements. For some grants, there’s an age restriction. SASSA won’t provide it if you are too young or old for a particular grant.

- Verification Failure. SASSA checks the info you give them. If problems or things don’t match up during this check, they might not give you the grant.

What Happens After the SASSA Application?

Once you submit your application, the following process takes place:

- SASSA tests the data you provide. They look at your name, ID number, and other information to ensure accuracy.

- SASSA checks information from special places to confirm what you have told them. They take a look at data from Home Affairs, the Unemployment Insurance Fund (UIF), the South African Revenue Service (SARS), and the National Student Financial Aid Scheme (NSFAS).

- Once they finish checking, SASSA sends you a message or notification. This message will tell you if they approved your application and you are getting the grant or if they had to say no.

Collection of SASSA SRD Payments

Once your account receives the grant money, the big question is: how do you get hold of this cash?

If you provided your bank account details during the application process and have an account, you will receive your payment disbursed into this account and can access it anytime you wish.

Otherwise, you can also receive your payment from their local Post Office, Pick’n’Pay, or boxer store. Once SASSA notifies you via SMS of the payment made, you will be able to receive these payments.

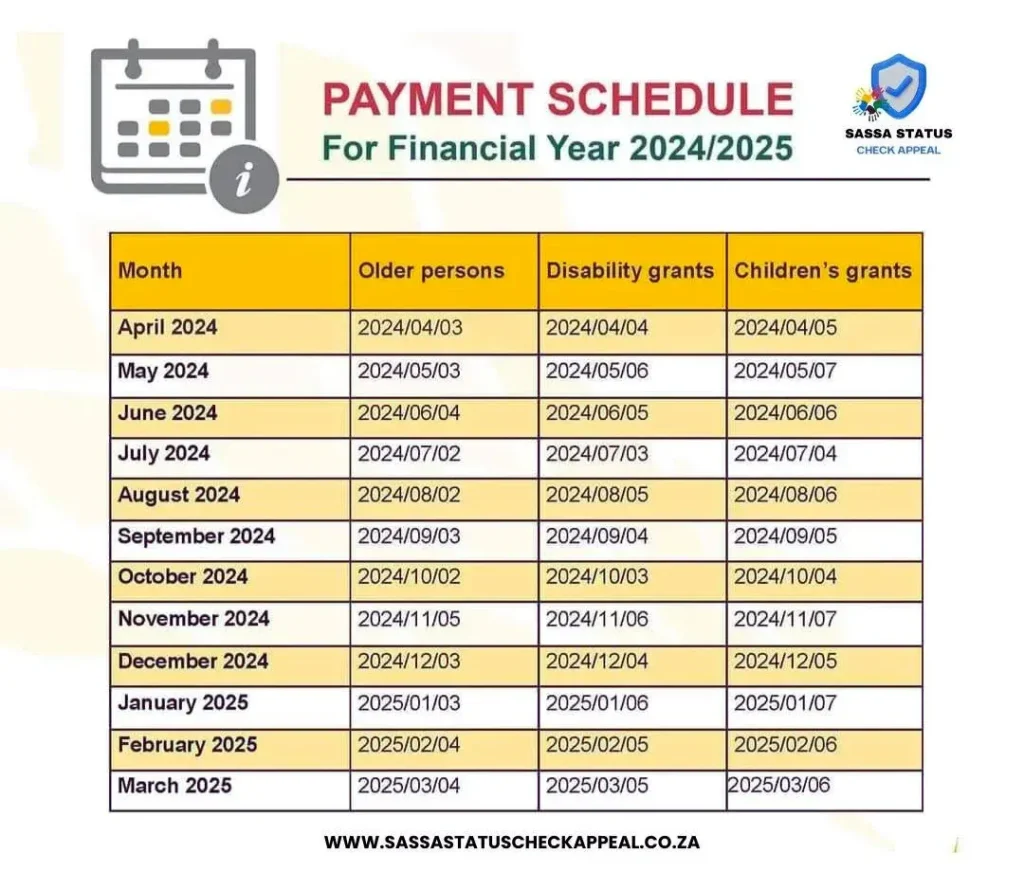

SASSA Payments Date Checklist

Here are the detailed SASSA payment and application dates for the year 2024, continuing through March 2025. This includes the month and year of the payment, the scheduled pay date for Older persons, Disability grants, and Children’s grants for each month.

Frequently Asked Questions

If you haven’t received an SMS despite an approved status, contact SASSA’s helpline at 0800-60-10-11 or contact the closest office for help. A missing payment date may indicate a processing delay.

Reapplication pending means that SASSA hasn’t received a new application or reapplication from you. If your application gets rejected, you must reapply to be considered again.

If your status is marked as Failed, double-check and correct the details you provided in the application. For further assistance, contact SASSA.

To check your SASSA status on Govchat, use the Govchat app or visit their website. For more assistance, contact them through e-mail at or the SRD website.

Conclusion

All in all, there is more than one way to check your SRD status online. All you need is your Applicant ID and the Mobile Number you used during registration. Keeping other information close is also good in case SASSA asks for more checks.

You can check your SRD Status on the official website, through SASSA’s WhatsApp number, by contacting SASSA through their helpline and the Moya app. You don’t need to worry about anything; all the instructions will be given to you no matter how you check. Follow those instructions carefully.

If your grant is approved, congratulations! Check the reason for the decline if it occurs, correct the issue, and reapply. Don’t worry; your second attempt will likely result in approval of your application.